Wage growth slows

- LiveWebChat

- Oct 14, 2025

- 2 min read

Wage growth in the UK has slowed significantly over the summer, reflecting a cooling labour market and rising economic uncertainty.

After months of steady increases, wage growth in the UK has begun to lose momentum, with recent data from the Office for National Statistics (ONS) showing a marked slowdown during the summer months. In the three months to August 2025, regular pay growth (excluding bonuses) fell to 4.7%, down from 4.8% in the previous quarter and marking the lowest rate in over three years.

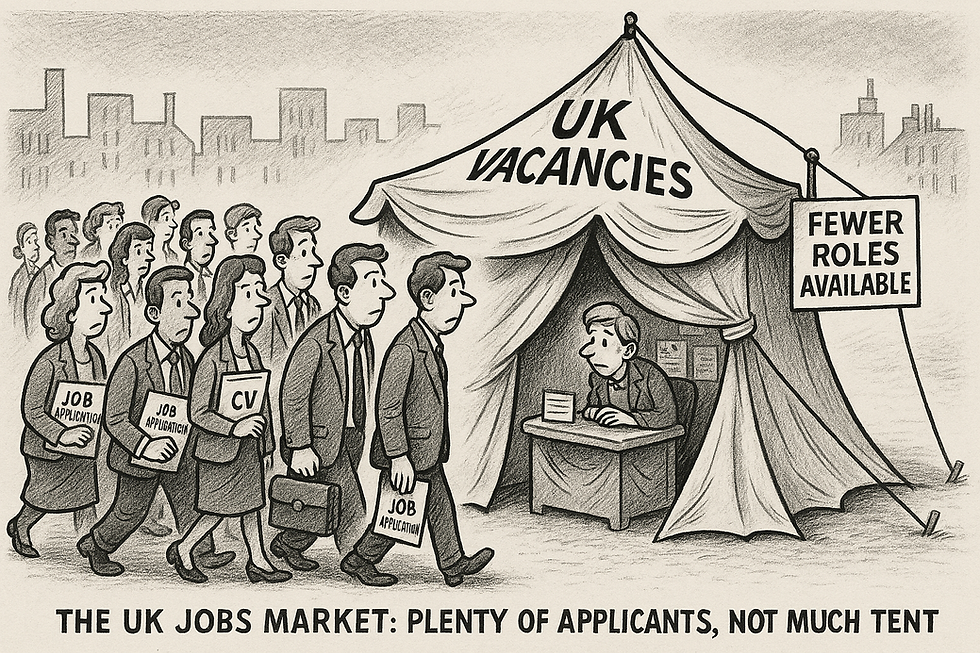

This deceleration comes amid broader signs of strain in the UK labour market. The unemployment rate rose to 4.8%, its highest level since May 2021, while the number of job vacancies declined by 9,000 between July and September. These figures suggest that employers are becoming more cautious, scaling back hiring and wage increases in response to economic pressures.

One of the key drivers behind the slowdown is the £26 billion payroll tax hike introduced earlier this year, which has increased costs for businesses and dampened their appetite for expanding payrolls. As a result, many companies have shifted towards fixed-term or freelance contracts, reducing job security and limiting wage growth opportunities for workers.

The impact is particularly evident in starting salaries, which grew at the slowest pace in over four years during July 2025. This trend indicates that employers are not only tightening budgets for existing staff but also offering less competitive compensation to new hires.

Despite the cooling wage growth, earnings remain above pre-pandemic levels. However, the real-term growth—adjusted for inflation—was just 1.2% for regular pay and 1.0% for total pay between May and July 2025. This modest increase suggests that workers are seeing limited improvements in purchasing power, especially as inflation continues to erode the value of their earnings.

The slowdown in wage growth has prompted speculation about future monetary policy. With the labour market softening and inflation pressures easing, some economists believe the Bank of England may consider adjusting interest rates in 2026 to support economic recovery.

While the data paints a picture of a labour market under pressure, there are signs of potential stabilisation. The number of payrolled employees increased by 10,000 from July to August, although provisional estimates for September suggest a decline of the same amount. This fluctuation indicates that while the worst of the shake-out may be over, recovery remains fragile.

In summary, the summer of 2025 has seen a notable cooling in UK wage growth, driven by higher employer costs, cautious hiring, and broader economic uncertainty. As policymakers prepare for the autumn budget, the evolving labour market will be a key factor in shaping fiscal and monetary decisions in the months ahead.

We help many small and medium businesses avoid the cost of employing staff, saving them time and money by providing real trained staff to answer chats directly on their websites on their behalf. Our software is protected by the very latest technology as well, meaning you can rest assured that we've got you covered.

Contact us today to find out more about how Live Web Chat can help you convert website visitors into paying clients. You can find out more about what we offer on our website, or by calling us on 01273 741113.